International Student Employment

International student employment is highly regulated, but there are opportunities for you to seek employment while you are there. If you are interested in pursuing one of the work opportunities available to you, please be sure to review all related information on this website and work closely with your International Student Advisor to ensure you are always working within the guidelines of your particular student visa.

Remember; any unauthorized, off-campus employment is strictly prohibited. If it is discovered you are/have been working illegally, as per USCIS regulations, your visa must be terminated immediately.

International students in valid F-1 or J-1 status are permitted to work on-campus without any special authorization. Students can start on-campus employment once they arrive on campus, complete the mandatory orientation program and begin classes.

- Students can work up to 20 hours per week while school is in session.

- Students can work up to 40 hours per week during official school breaks.

- Students may not work on-campus after their Program End Date.

There are many different employment opportunities available on-campus for international students. You can browse the available on-campus positions via Handshake. You can also contact a campus program or academic department directly to ask if they are hiring student assistants. Visit our Career Services website for useful tips and resources on how to prepare a successful resume and how to interview with employers in the United States.

Click here to download our On-Campus Employment Information Guide if you're interested in seeking on-campus employment (you must use your SSU account to access the document).

Employers will require that you apply for a Social Security Number (SSN) before you may start working. Because it can take several weeks to receive your SSN, it is advisable to start the process immediately after receiving a job offer.

You must complete the following steps in order to receive a social security number:

- Secure a job and have the person hiring you complete the Employer Certification.

- For students who have been hired for an on-campus position at Sonoma State, please provide this Employer Certification form for your employer to complete.

- For students who have been hired outside of Sonoma State, please provide this Employer Certification form for your employer to complete.

- Make an appointment with your International Advisor and bring the letter signed by your hiring department. Your advisor will complete the DSO/ARO certification.

- Take this letter, along with your passport, F-1/J-1 visa, Form I-20/DS 2019, and most recent I-94 record (retrievable from i94.cbp.dhs.gov) to any Social Security Office. The closest office is 2099 Range Ave., Santa Rosa, CA 95401 (Building A).

You must have your SSN before you may receive wages for working on-campus, so be sure to apply as soon as possible after you receive an offer of employment, and bring the SSN application receipt to your employer as evidence.

An F-1 / J-1 student may start work while their Social Security Number application is being processed. Employers may reference Social Security Administration’s fact sheet, Employer Responsibilities When Hiring Foreign Workers, which contains information on how to report wages for an employee who has not yet received an SSN.

It is not required that students receive their Social Security Number before they start work. However, the Internal Revenue Service (IRS) requires employers to report wages using an SSN. While you wait for your SSN, your employer can use a letter from us stating that you applied for a number. Your employer may use your immigration documents as proof of your authorization to work in the United States. Employers can find more information on the Internet at https://www.socialsecurity.gov/employer/hiring.htm.

Employers may contact the Global Engagement Office for any questions or concerns. While we cannot answer questions about specific students, we are happy to give general guidance on hiring and working with international students.

General Information

Cirricular Practical Training (CPT) is an opportunity for students in degree-seeking programs to gain work experience outside the Sonoma State Campus.

CPT Guidelines

- CPT is only available to F-1 students in degree-seeking programs. English Language learners and exchange students are not eligible to apply.

- CPT must be utilized for any off-campus employment or internship opportunity, even if it is unpaid.

- Students interested in volunteering for a one-time event for a non-profit organization do not need to apply for CPT.

- The work you perform for CPT must directly relate to your major and must be an integral part of your program of study. You must also be enrolled in an internship course for each semester of CPT participation. This means your CPT start and end dates must fit within the first and last day of the applicable semester.

- All students must provide a written explanation of how the specific job they will be performing while on CPT directly relates to their major of study. You need to be able to cite specific classes in this explanation.

- Students who participate in CPT can either be an unpaid intern or work as a formal employee (via a W-2 tax status). CPT students cannot be an independent contractor (via a 1099 tax status).

- CPT is only available after completion of one year of academic study in F-1 status.

- Exception: Students who have gone through the Change of Status process to an F-1 student visa and have been continually enrolled full-time for an academic year during the Change of Status period.

- If you have 12 months or more of full-time CPT, you are ineligible for OPT. Part-time CPT will not limit your participation in OPT.

- You must apply for work authorization from your DSO by submitting one of the forms below.

- Once you apply and are approved, you cannot begin employment until your International Student Advisor/DSO has issued you your updated I-20 with the correct CPT start and end dates indicated on the 2nd page of your I-20.

Current CPT Students

- Be sure to communicate with your International Student Advisor/DSO about a new employment or change in employment as soon as possible by accessing the appropriate form below.

General Information

Optional Practical Training (OPT) is a temporary employment authorization for F-1 students. The purpose of OPT is to give students the opportunity to gain work experience in their major field of study. OPT must be recommended by your International Student Advisor/Designated School Official (DSO) and approved by the United States Citizenship and Immigration Services (USCIS): https://www.uscis.gov/opt.

OPT Guidelines

- OPT is only available to F-1 students who have completed a degree program.

- OPT must relate to the degree program's field of study. You should be prepared to give specific examples of how your employment while on OPT is directly related to skills you learned in specific courses.

- You are eligible to apply for 12 months of OPT at each education level, (i.e. associate’s, bachelor’s, master’s, doctorate).

- You must apply for work authorization from the U.S. Citizenship and Immigration Services (USCIS). The application fee is $410.

- You can apply for OPT up to 90 days before or 60 days after the Program End Date indicated on your I-20. It is highly recommended that students apply for OPT as soon as they are eligible to.

- Students who are interested in OPT are required to review all the information in the OPT Module of the International Student Online Orientation in Canvas.

- You cannot apply for OPT without an I-20 with OPT recommendation indicated on the 2nd page of your I-20. You need to complete the OPT Module of the Canvas course in order to receive your I-20 with OPT recommendation from your International Student Advisor/DSO.

- Post-completion OPT must be full-time (at least 20 hours per week).

- You do not need to have a job offer in order to apply for OPT.

After Applying for OPT

Confirmation from USCIS

USCIS will mail you an I-797C Notice of Action after receiving your application. It will note the date your application was received and the date the receipt was mailed, as well as an EAC

number. You can check you case status online: https://egov.uscis.gov/casestatus/landing.do. If you do not receive a Notice of Action within 6 weeks of mailing your application, submit an inquiry online: https://egov.uscis.gov/e-request/displayNDNForm.do?entryPoint=init&.

EAD Card

USCIS work authorization is issued in the form of an Employment Authorization Document (EAD), which is a photo identity card that indicates the start/end dates for employment. If you

do not receive your EAD within 90 days of your “Received Date” on the I-797C, submit an inquiry online: https://egov.uscis.gov/e-request/displayNDCForm.do?entryPoint=init. Upon receipt of your EAD, submit a photocopy to your DSO.

Remember that you are not allowed to begin employment unless you have your physical EAD card.

Employment Start Date

- You may not begin work until all three of the following requirements are satisfied:

- You have physically received your EAD card.

- The date is reached on which the EAD authorizes employment to begin (OPT Start Date).

- You have reported your Employer Information and submitted your employment offer letter via this online form to your DSO.

Active OPT Participants

- Remember that you have a 90-day unemployment limit. If a student accrues an aggregate of more than 91 days of unemployment, their program will end, and they must leave the U.S. immediately. No grace period is granted for these cases.

- Please click here to report a new employer.

- Please click here to report a change/update current employment information.

- Please click here to report a change of address/phone number as required by your visa.

Traveling Outside the US While on OPT

- If you are considering traveling outside the U.S. after your Program End Date, while your OPT is pending, please contact your International Student Advisor.

- If you are traveling outside the U.S. after your OPT has been approved, please be sure to have the following documentation with you to present upon reentry to the U.S..

- I-20 with Valid Travel Signature:

- When traveling during OPT, the travel signature is only valid for re-entry to the U.S. within 6 months of the signature date.

- Valid Passport:

- Must be valid 6 months beyond your date of re-entry to the U.S. Passports may be renewed at your country’s embassy or consulate within the U.S.

- Valid U.S. Visa:

- A student visa must be valid at the time of re-entry (Citizens of Canada do not require a visa.)

- Exception: Automatic Visa Revalidation [8 CFR 214.1(b)(3)]: F and J non-immigrants can usually re-validate an expired visa automatically when returning to the U.S after a visit of less than 30 days to Canada, Mexico, or adjacent islands except Cuba.

- If you intend to use automatic visa re-validation, travel with your printed I-94.

- Travel During OPT Authorization:

- Valid Employment Authorization Document (EAD/OPT Card) AND Job Offer/Letter for Employment in Major Field of Study

- Bring recent pay stub/proof of employment if possible

- I-20 with Valid Travel Signature:

General Information

Students who earn a degree in Science, Technology, Engineering, or Mathematics (STEM) may be eligible to apply for an additional 24 months of post-completion OPT for a total of 36

months. STEM OPT must be recommended by your Designated School Official (DSO) in the Global Engagement Office (GEO) and approved by the United States Citizenship and Immigration Services (USCIS): https://www.uscis.gov/working-in-the-united-states/students-and-exchange-visitors/optional-practical-training-extension-for-stem-students-stem-opt

STEM OPT Application Instructions

- You have completed a Bachelor’s degree or higher in an approved STEM field: https://studyinthestates.dhs.gov/eligible-cip-codes-for-the-stem-opt-extension.

- You are currently engaged in Post-Completion OPT (not Pre-Completion OPT) in your major field of study and have not exceeded 90-days of unemployment.

- Your STEM OPT application is based on the same degree as your Post-Completion OPT application, not from a previous degree.

- You have not received a 24-month STEM OPT extension previously.

- You have a job or job offer from an employer who is participating in the USCIS E-Verify Program: http://www.uscis.gov/e-verify.

- Your STEM OPT employer must agree to report the termination or departure of the student to the GEO, or through any other process chosen by the DHS.

If you would like to apply for an OPT STEM Extension, please click here fill out the STEM OPT Extension Request form.

E-Verify

- E-Verify is an Internet-based system operated by DHS in partnership with the Social Security Administration (SSA) that allows participating employers to electronically verify the employment eligibility of their newly hired employees.

- A list of employers who have self-reported participation in E-Verify is maintained by USCIS but students are advised to confirm with employers directly regarding eligibility.

- An employer's participation in E-Verify is voluntary and is currently free to employers.

Types of Acceptable Employment for 24-Month Extension

A student authorized for a 24-month extension must work at least 20 hours per week for an E-Verify Employer in a position directly related to their DHS-approved STEM field. For a student who is on a 24-month extension, this employment may include:

- Multiple employers: A student may work for more than one employer, but all employment must be related to his or her degree program and all employers must be enrolled in E-Verify;

- Work for hire: This is also commonly referred to as 1099 employment, where an individual performs a service based on a contractual relationship rather than an employment relationship. The company for whom the student is providing services must be registered with E-Verify. If requested by DHS, the student must be prepared to provide evidence showing the duration of the contract period and the name and address of the contracting company;

- Self-employed business owner: A student on a 24-month extension can start a business and be self-employed. In this situation, the student must register his or her business with E-Verify and work full time. The student must be able to prove that he or she has the proper business licenses and is actively engaged in a business related to his or her degree program;

- Employment through an agency or consulting firm: A student on a 24-month extension may be employed by an employment agency or consulting firm. The employment agency or consulting firm must be registered with E-Verify, but the third parties contracting with the agency or firm (for which the student is providing services) need not be

When to Apply

- STEM applications may be submitted to USCIS up to 120 days before your Post-Completion OPT ends.

- USCIS must receive your application by the last day of your current OPT authorization. You cannot apply for the STEM extension after your Post-Completion OPT End Date.

- USCIS must receive your application within 60 days of the DSO recommendation.

How to Apply

- Read all the STEM OPT extension information included on this portion of the webpage.

- Prepare your application materials and submit them to your DSO for review via the GEO online STEM OPT Request form.

- Complete and submit the Form I-983 Training Plan to your DSO: https://studyinthestates.dhs.gov/stem-opt-hub/for-students/students-and-the-form-i-983

- Complete and submit the OPT Employer Information form

- Apply for OPT via filing an I-765 online

Checklist for e-Filing

NOTE: All evidence materials/documents must meet USCIS’s specified file requirements to ensure successful uploads within the e-File system. Please be sure that all pictures or scans show the required information clearly. You must be physically present in the U.S. to file your STEM OPT application.

- Recent 2 x 2 passport-style photo

- Clear image of your current I-94 record (you must be physically in the U.S.)

- Clear image of your current EAD for your Post-OPT

- Clear image of STEM OPT Form I-20 with your ORIGINAL (physical) signature on page 1

- Clear image of your passport biographical page(s) uploaded under section “ Employment Authorization Document”

- Clear images of your diploma AND official transcripts related to your STEM degree program uploaded under “College Degree”

- $410 for the I-765 Filing fee available to be paid visa credit card or direct bank withdrawal.

Once you have everything prepared, please use the STEM OPT Online Application Tutorial to apply.

After Applying for STEM OPT

Confirmation from USCIS

USCIS will mail you an I-797C Notice of Action after receiving your application. It will note the date your application was received and the date the receipt was mailed, as well as an EAC number. You can check your case status online: https://egov.uscis.gov/casestatus/landing.do. If you do not receive a Notice of Action within 6 weeks of mailing your application, submit an inquiry online: https://egov.uscis.gov/e-request/displayNDNForm.do?entryPoint=init&.

Employment Authorization Card (EAD)

USCIS work authorization is issued in the form of an Employment Authorization Document (EAD), which is a photo identity card that indicates the start/end dates for employment. If you do not receive your EAD within 90 days of your “Received Date” on the I-797C, submit an inquiry online: https://egov.uscis.gov/e-request/displayNDCForm.do?entryPoint=init. Upon receipt of your EAD, submit a photocopy to your DSO.

Working While Application is Pending

As per 8 CFR 274a.12(b)(6)(iv), if you file your STEM OPT extension application on time and your OPT period expires while your extension application is pending, USCIS will automatically extend your employment authorization for 180 days. This automatic 180-day extension ceases once USCIS adjudicates your STEM OPT extension application.

Traveling Overseas While Application is Pending

Although you may continue to work, you cannot travel outside the U.S. if your STEM OPT extension application is pending and your current OPT EAD has expired. You must wait in the U.S. to receive the new EAD for STEM OPT.

120-Day Unemployment Limit

As per 214.2(f)(10)(ii)(E), students who receive a 24-month STEM OPT extension are given an additional 60 days of unemployment for a total of 150 days over the entire post-completion

OPT period of 36 months.

Request for Evidence (RFE)

USCIS may send you a Request for Evidence (RFE) notice by mail. If you receive an RFE, contact your DSO. You must provide the requested information to USCIS by the required deadline before your EAD can be issued. USCIS typically gives applicant 30 days to respond to an RFE. Your application will be denied if you fail to meet the requirements of the RFE.

Maintaining Status

Students on the STEM OPT extension must be sure to verify their information every 6 months as well as provide updated I-983 documents to their DSO:

- STEM OPT students are required to verify the validity of their information and employment every 6 months starting on the Start Date of their STEM OPT extension. To verify your information, please click here.

- Submit an updated I-983 Training form to your DSO within 12 months of your STEM OPT Start Date.

- Submit a final I-983 that recaps all the training and knowledge acquired during the complete training period at the end of the STEM OPT Extension.

- Students who change employers during their STEM OPT are required to submit a final I-983 for their previous employer and start a new I-983 for their new one. They still must report on their training within 12 months of the OPT Start Date.

- Request a travel authorization signature on your I-20 before you leave the U.S. Email your DSO and they will send you a new I-20 with a travel signature.

Academic Training (AT)

- AT is only available to J-1 students.

- AT must be directly related to your major field of study.

- AT is available both during (pre-completion) and after (post-completion) your program.

- Pre-completion AT allows you to work part-time while classes are in session and full-time during vacation periods.

- You must maintain adequate health insurance coverage throughout the period of AT.

- AT may not exceed 18 months, or the duration of your program, whichever is shorter.

- For more information about AT, review the AT Application Instructions.

Overview

If other employment opportunities are not available or are otherwise insufficient, an eligible F-1 student may request employment authorization based on severe economic hardship caused by unforeseen circumstances beyond the student's control. These circumstances may include a loss of financial aid or on-campus employment without fault on the part of the student, substantial fluctuations in the value of currency or exchange rate, inordinate increases in tuition and/or living costs, or unexpected changes in the financial condition of the student's source of support, medical bills, or other substantial and unexpected expenses. Source: [8 C.F.R. 214.2(f)(9)(ii)(C)-(D) and (F)].

Eligibility Criteria

You are eligible to apply for employment based on severe economic hardship if:

- You have been in F-1 status for one full academic year.

- You are in good academic standing (minimum 2.0 GPA) and are taking a full course load.

- Employment will not interfere with your studies.

- You can demonstrate that employment is necessary to avoid severe economic hardship due to unforeseen economic circumstances beyond your control.

- You can demonstrate that on-campus employment is not available or is insufficient to meet your financial needs.

Documentation Needed to Apply

- Personal statement describing the unforeseen hardship situation and, if possible, attach backup documentation; for example, news articles, a letter from home telling of a change in family circumstances or proof of a currency devaluation in your country, etc.

- Documentation showing that on-campus employment opportunities are not available or are insufficient to meet your financial needs.

- Completed Form I-765, using the code (C)(3)(iii) at item 16; do not date the form until you are ready to send the application to the U.S. Citizenship and Immigration Services (USCIS).

- Copies of your current and previous I-20s

- Copy of paper or print-out of electronic Form I-94 (please click on the link for instructions)

- Copy of your F-1 visa page (except Canadians) or I-797 (approval of change of status to F-1)

- Copy of your unofficial transcript available from MySSU portal

- $410 Filing Fee (can be paid via money order, personal check, cashier's check or pay by credit card using Form G-1450, Authorization for Credit Card Transactions. If you pay by check, you must make your check payable to the U.S. Department of Homeland Security

How to Apply for Severe Economic Hardship

- Fill out the Economic Hardship Request form

- Submit the requested documentation to [email protected]

- If your request is approved, you'll be issued a new I-20

Submitting Your Severe Economic Hardship Application to USCIS

Once you have requested a Severe Economic Hardship Employment recommendation and received your new I-20 from the CIE, you will need to prepare and submit the following list of items to USCIS:

- Two passport photos, taken no more than 30 days before filing the form. You can have these photos taken at the CIE ($4 fee), or you can go to the U.S. Post Office or any CVS location.

- Form I-765 filing fee - $410 check or money order made payable to U.S. Department of Homeland Security. To request a fee waiver, you should also include a Form I-912, Request for Fee Waiver. Review USCIS guidance on fee waivers before completing the Form I-912. Form I-765

- A copy of your new I-20 with employment recommendation

- Copies of your previous I-20(s)

- Copy of your passport

- Copy of your F-1 visa or I-797

- Copy of your Form I-94

- Your personal statement along with any other supporting documents

Mailing to USCIS

Send your complete request to the USCIS Phoenix Lockbox at one of the following locations:

- For U.S. Postal Service (USPS) First-Class and Priority Mail Express deliveries: o USCIS P.O. Box 21281 Phoenix, AZ 85036

- For overnight/courier deliveries (non-USPS, i.e. FedEx, UPS): o USCIS Attn: AOS 1820 E. Skyharbor Circle S Suite 100 Phoenix, AZ 85034

Approval Process

If the application is approved, USCIS will issue an EAD (Employment Authorization Document) to you. If the application is denied, you will be notified by USCIS in writing. You may not begin employment until you have received the EAD and the dates are valid.

Location

This authorization is designed for off-campus employment. On-campus employment is already permitted under the F-1 visa.

The authorization is granted in one-year intervals, or until the program end date, whichever is shorter.

Hours Per Week

You may work part-time (up to 20 hours per week) while school is in session and full-time (up to 40 hours per week) during official university holidays.

Field/Level of Work

Employment can be anywhere you find a position and does not have to be related to your course of study.

General Tax information

Sonoma State University does not verify that you fulfill your tax obligations. However, we do want to ensure that you are provided with all of the information possible to ensure that you do file your taxes/forms successfully.

When do I file my taxes?

Taxes are based on each calendar year (January 1st- December 31st). Generally, you can file your taxes/submit the appropriate forms between January 1st and April 15th for the previous year's taxes.

Who needs to file taxes?

Any F-1 or J-1 student who received income in the United States for the previous calendar year.

What if I didn't work or receive income for the previous calendar year?

If you did not receive any source of income in the United States during the past calendar year, then you do not need to file income tax returns.However, you are obliged to still file a Form 8843 with the IRS.

You can file your Form 8843 with Sprintax, but you will have to pay their service fee.

If you would like to file your Form 8843 by hand, please click here to access our guide on how to complete and submit the form.

What is the IRS?

The IRS (Internal Revenue Service) is the United States’ federal institution which collects and analyzes taxes for the country. It is important to note that when you work in the United States, you will be paying both Federal and State income taxes.

Information on Filing Taxes as an F-1/J-1 Students

If you earned income in the United State in the previous calendar year, then you are obligated to file taxes with the IRS and the State of California.

Filing taxes can be a complicated process, so that is why Sonoma State University has arranged access to Sprintax Tax Preparation for you. Sprintax will guide you through the tax preparation process, arrange the necessary documents and check if you’re due a tax refund.

Sprintax was used by over 225,000 international students and scholars last year, and the average Federal refund received by eligible students was over $1,126.

Sonoma State University does not receive any compensation for recommending Sprintax Tax Preparation services. We promote their services simply because they can make the tax-filing process much easier.

Students can also see the support of a tax professional to file their taxes.

You can click here for a full explanation of F-1 tax information.

You can click here for a full explanation of J-1 tax information.

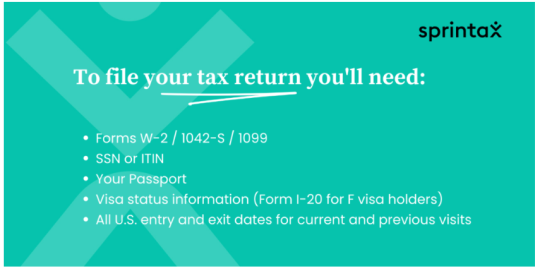

- You should receive your W-2 form from your employer(s) between mid-January and mid-February. Reach out to your employer if you have questions about your W-2.

- If you were working as an independent contractor, then you should also receive 1099 forms from each of your clients

- Once you have your W-2/1099s, you can file your tax return

- Filing Taxes via Sprintax

- Click here for information on filing your taxes through Sprintax

- Create or log in to your Sprintax Account

- Sprintax estimated costs

- Federal taxes starting at $55

- State taxes starting at $50

- Average Refunds after filing (money you may get back)*

- Federal: $914

- State: $460

*please note there is no guarantee that you will receive this amount in refunds as it is based on each individual’s specific circumstances